Wells Fargo Autograph Sign Up Bonus

Start with $200 in cash redemption value by earning 20,000 bonus points when you spend $1,000 in purchases within the first 3 months.

ADVERTISEMENT

Are you looking for a new credit card? Do you want one that offers a generous sign-up bonus? Look no further than the Wells Fargo Autograph℠ Card.

This card offers an impressive 20,000 bonus points when you spend $1,000 in purchases in the first 3 months. That’s equivalent to a $200 cash redemption value!

Publicidade

But that’s not all this card has to offer. In addition to the sign-up bonus, the Wells Fargo Autograph℠ Card also offers a range of other benefits and rewards. Keep reading to learn more about this exciting offer and how you can take advantage of it.

Click here to access the promotion page

Wells Fargo Autograph Sign Up Bonus Benefits

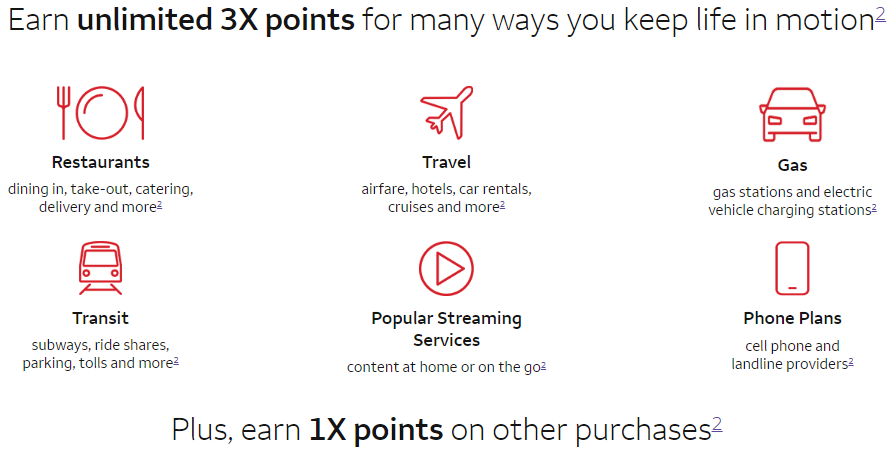

This card offers unlimited 3X points for a variety of categories that suit your lifestyle, whether you are dining out, traveling, driving, commuting, streaming or calling. Here are some of the benefits of this card:

- Restaurants: You can earn 3X points for every dollar you spend on dining in, take-out, catering, delivery and more. Whether you are craving pizza, sushi, burgers or salads, you can enjoy your favorite meals and earn points at the same time.

- Travel: You can earn 3X points for every dollar you spend on travel expenses, such as airfare, hotels, car rentals, cruises and more. Whether you are planning a vacation, a business trip or a weekend getaway, you can book your travel with confidence and earn points along the way.

- Gas: You can earn 3X points for every dollar you spend on gas stations and electric vehicle charging stations. Whether you are driving a car, a truck or a hybrid, you can fill up your tank or charge your battery and earn points for it.

- Transit: You can earn 3X points for every dollar you spend on transit expenses, such as subways, ride shares, parking, tolls and more. Whether you are commuting to work, school or anywhere else, you can save time and money and earn points for it.

- Popular Streaming Services: You can earn 3X points for every dollar you spend on popular streaming services, such as Netflix, Hulu, Spotify and more. Whether you are watching movies, shows, music or podcasts at home or on the go, you can enjoy your favorite content and earn points for it.

- Phone Plans: You can earn 3X points for every dollar you spend on phone plans from cell phone and landline providers. Whether you are calling your family, friends or colleagues, you can stay connected and earn points for it.

In addition to these categories, you can also earn 1X points for every dollar you spend on other purchases. There is no limit to how many points you can earn with this card. You can redeem your points for gift cards, travel and more.

Click here to access the promotion page

Wells Fargo Autograph Sign Up Bonus Redeem

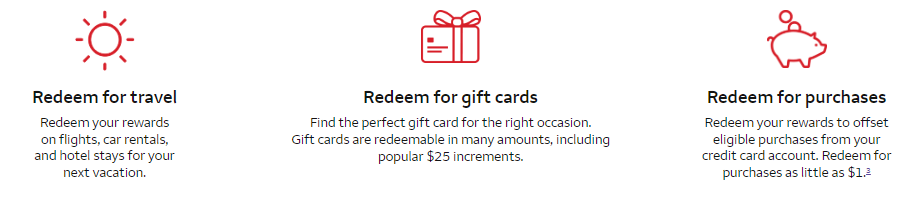

One of the best things about the Wells Fargo Autograph card is that you have many options to redeem your rewards. You can use your points for travel, gift cards, purchases, PayPal and more. Here are some of the ways you can be rewarded with this card:

- Travel: You can use your points to book your travel through the Wells Fargo Rewards website or by calling the travel center. You can redeem your points for flights, car rentals, hotel stays and more. You can also transfer your points to participating airline and hotel loyalty programs .

- Gift Cards: You can use your points to get gift cards from hundreds of retailers, restaurants, entertainment venues and more. You can find the perfect gift card for yourself or someone else. Gift cards are available in many amounts, including popular $25 increments.

- Purchases: You can use your points to offset eligible purchases from your credit card account. You can redeem your points for purchases as little as $1. You can choose from categories such as gas, groceries, dining, travel and more.

- PayPal: You can use your points to shop at millions of online stores and pay with PayPal. You can redeem your points when you check out with PayPal and choose Pay with Rewards. You can also link your Wells Fargo Rewards account to your PayPal account and see your available rewards balance when you log in to PayPal.

These are just some of the ways you can redeem your rewards with the Wells Fargo Autograph card. For more information on how to redeem your rewards, visit wellsfargo.com/rewards.

The Wells Fargo Autograph card gives you the flexibility and freedom to use your rewards the way you want. Whether you want to travel, shop, save or splurge, you can find the right option for you.

Wells Fargo Autograph Review

The Wells Fargo Autograph Card is a no-annual-fee credit card that offers unlimited 3X points on several categories, such as restaurants, travel, gas, transit, streaming services and phone plans. It also offers a welcome bonus of 20,000 points (worth $200) when you spend $1,000 in the first 3 months. The card has some valuable perks, such as cell phone protection, Visa Signature Concierge and no foreign transaction fees. However, it also has some drawbacks, such as no travel transfer partners, no introductory APR on balance transfers and a high balance transfer fee. Here are the pros and cons of this card:

Pros

- No annual fee: You don’t have to pay anything to keep this card in your wallet and enjoy its benefits.

- Bonus categories: You can earn 3X points on the following categories:

- Restaurants: dining in, take-out, catering, delivery and more.

- Travel: airfare, hotels, car rentals, cruises and more.

- Gas: gas stations and electric vehicle charging stations.

- Transit: subways, ride shares, parking, tolls and more.

- Streaming services: Netflix, Hulu, Spotify and more.

- Phone plans: cell phone and landline providers.

- Welcome bonus: You can earn 20,000 bonus points (worth $200) when you spend $1,000 in purchases in the first 3 months.

- Redemption options: You can redeem your points for travel, gift cards, statement credits or PayPal. You can also transfer your points to participating airline and hotel loyalty programs.

- Cell phone protection: You can get up to $600 of cell phone protection against damage or theft when you pay your monthly cell phone bill with your card (subject to a $25 deductible).

- Visa Signature Concierge: You can enjoy a premium collection of benefits at a selection of the world’s most intriguing and prestigious hotel properties with Visa Signature Concierge.

- No foreign transaction fees: You don’t have to pay any extra fees when you use your card abroad.

Cons

- No travel transfer partners: You can’t transfer your points to any travel partners directly. You have to use the Wells Fargo Rewards website or call the travel center to book your travel or transfer your points to participating airline and hotel loyalty programs.

- No introductory APR on balance transfers: You don’t get any interest-free period on balance transfers.

- Balance transfer fee: You have to pay a fee of up to 5% (minimum $5) for each balance transfer you make.